When buying a home, many homebuyers tend to search for the best mortgage interest rates available. While some may find that perfect rate, others may opt to take advantage of lender-provided options, such as mortgage points.

Mortgage points are designed to help buyers bring down their interest rates by paying them ahead of time. Sometimes considered “discount points,” mortgage points allow you to pay a larger down payment up front to quell your interest rates throughout the life of your loan.

While that sounds like an excellent option for those searching to put a dent in their future monthly payments, there are a few items to consider.

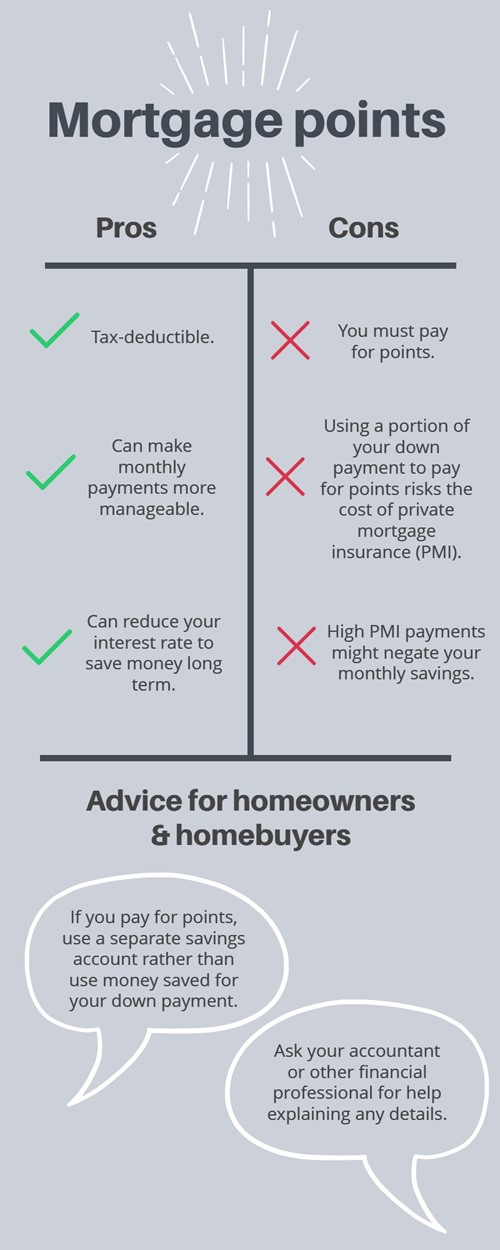

Here are some pros and cons of mortgage points and tips on what to do for your situation:

When delving into the world of mortgage discount points, the immediate hook is your monthly savings in the long term. Mortgage points are exceptional ways to bring your mortgage interest rate into a desirable range, creating more manageable payments on a monthly basis.

Another fantastic feature of mortgage points is they’re tax-deductible. According to the IRS, you can itemize your deductions on a Schedule A, or Form 1040, and only need to meet a few requirements, such as using the “cash method” for tax reporting. You’ll also need to have your primary residence as the loan’s security method.

There are great advantages to discount points. However, there are a few cons that may surface with this kind of lender program. For example, if you plan to pay for mortgage points, try to secure a secondary savings account to make that payment instead of taking it from your down payment.

If you take the funds from your initial down payment, you could end up paying less than the 20% needed to avoid private mortgage insurance, or PMI. Since PMI can increase your monthly payments, you may end up paying more on your monthly mortgage than you’d save, or you could end up pushing out your break-even point, prolonging your larger payments.

There are ways to use mortgage points to your advantage. For starters, make sure you have an in-depth understanding of your current monthly finances, your projected finances and a financial roadmap for the next few years that you can follow easily.

Another fantastic idea is to get in touch with your loan officer or lender. Have them explain your options, what the estimates are for the next few years (or further) and any tips they may have for you. If you find yourself in the beginning stages of your home search, ask your real estate agent for any connections or recommendations to a lender or loan officer.

Eileen is a Licensed Real Estate Salesperson and has been in the industry since 2004. Her experience in home sales range from a $4,000,000 single family home to a $100,000 Co-op. She covers both Westchester and Putnam County and works with both buyers and sellers. "My love for Westchester and particularly the Hudson River Valley is one of the many reasons why I enjoy working in real estate". She is a lifelong resident of Westchester County. She grew up in Tarrytown and moved to Briarcliff Manor where she raised her family. She received her MPA from Pace University and worked many years in the Human Resources field. She held the title of Vice President of HR for the largest teaching hospital in Westchester and Director of Classification and Compensation for one of the largest employers in Westchester County. After a successful HR career, Eileen decided to retire to make a full time commitment to her real estate clients. Outside of work you can find Eileen on the Tennis, Platform, or Pickleball Court along with Hiking in Westchester or the surrounding counties.